According to doanhnhansaigon, the Vietnamese government is seeking opinions on revising and supplementing the export and preferential import tax rates, commodity catalogs and absolute quotas of "Government Order 26/2023/ND-CP".

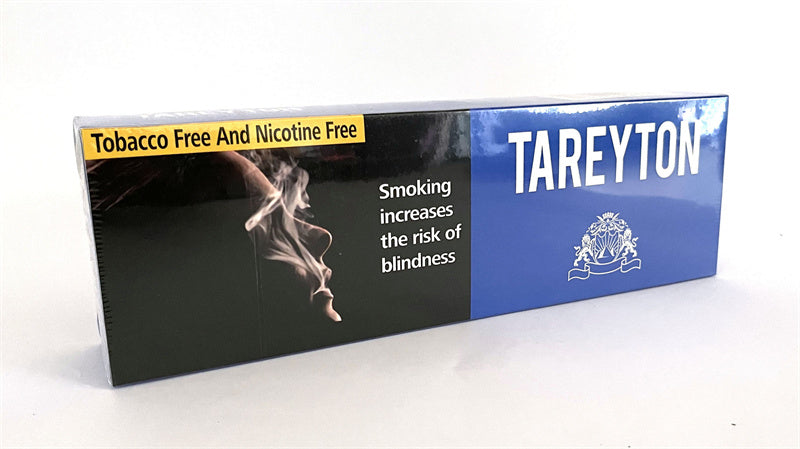

Especially for the preferential import tax rate for personal electronic equipment and similar vaporization equipment No. 8543.40.00, it is considered necessary to set a tax rate just like the goods in group 24.04 to restrict the use of products harmful to health.

Vietnam’s Ministry of Finance stated that the import tax on e-cigarette products should be set at the same 50% as traditional tobacco products to prevent their widespread circulation.

In addition, the Vietnamese government also disclosed that currently, as there is no clear policy on e-cigarette products, such products have not yet officially entered the Vietnamese market, and most e-cigarette products on the market are smuggled.