In an industry that's in long-term decline, like tobacco, companies face tough strategic choices. They can extract maximum value from legacy assets, liquidate their equity, or they seek to build new sustainable businesses.

Trying to do both at the same time creates execution risks. British American Tobacco faces a dilemma.

Its traditional business, which accounts for more than 85% of its sales and earns all its profits, is suffering. BAT prefers to call it a combustion business rather than tobacco. On Wednesday (December 6), it announced market data that Renault's US unit's asset impairment of 25 billion pounds and lower growth expectations had "burned" nearly one-tenth of the company's value.

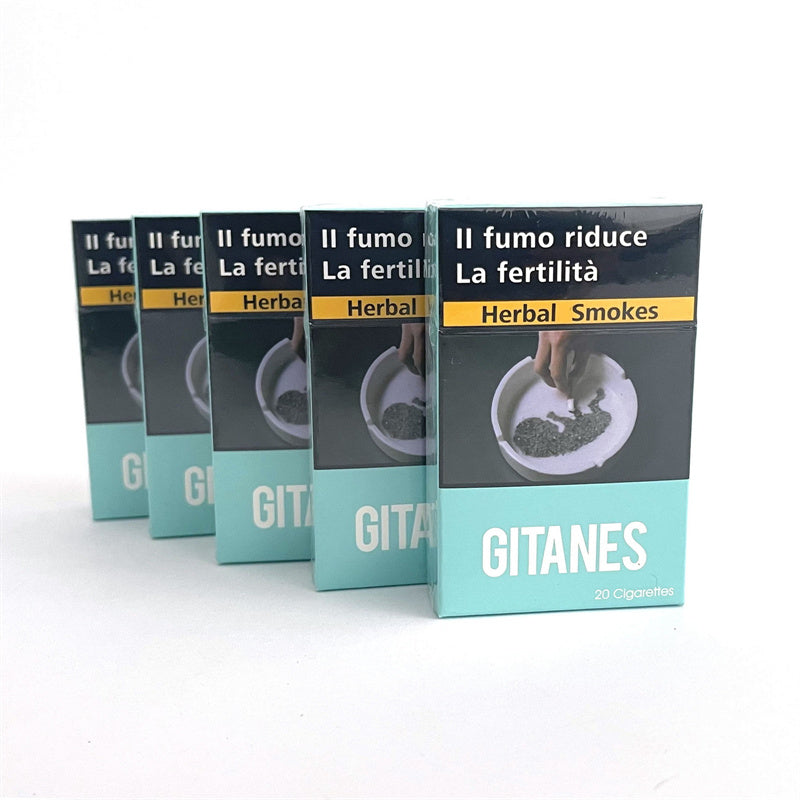

Especially in the United States, the rising cost of living and the emergence of disposable e-cigarettes will cause cigarette sales to fall by 11% in 2022. British American Tobacco launched luxury brands such as Camel into the consumer market, which performed poorly.

The company's sales this year are only expected to meet the bottom line of the 3-5% growth range. However, when sales drop significantly, it becomes difficult to raise prices. British American Tobacco is currently forecasting below-average growth through 2026, which is one reason for its share price reaction.

In the rather nebulous world of accounting, this means the group no longer sees its American brand as a timeless value. By shortening its economic life to 30 years, BAT has cut off 25 billion pounds of the 67 billion pounds it valued for its U.S. brands when it bought Reynolds American in 2017.

At that time, BAT invested US$49.4 billion to purchase the 57.8% stake it did not already own. This transaction made the entire enterprise value, including debt, exceed US$100 billion. While the impairment does not affect cash flow, it is still equivalent to half of BAT's current market capitalization.

E-cigarettes, heated tobacco products, and modern oral (nicotine pouches) are expected to break even this year, earlier than expected.

In fact, these businesses that are not large enough require a large amount of marketing expenses, which weakens their profit margins. A degree of government skepticism about smoke-free products doesn't help matters either. However, British American Tobacco still hopes that smoke-free products will become popular before tobacco is withdrawn from the market.

Given poor shareholder returns this year - even including a 10% gain - only a drop in global interest rates will bring investors back to BAT.